In this tutorial we will walk through on how to create a Volatility Yield strategy using a stable coins to generate yield on trading pairs such as ETH/USDT, SOL/USDT etc.

In this example we will create a Volatility Yield strategy with SOL/USD trading pair. If your exchange supports other stable coins such as USDT or USDC you can also use those to create trading pairs such as SOL/USDC.

- Login into your Renora account and go to strategies section.

- Click on “Create Strategy” and select “Custom Strategy“.

- Click on “Start” after reading the strategy details and select a connected exchange.

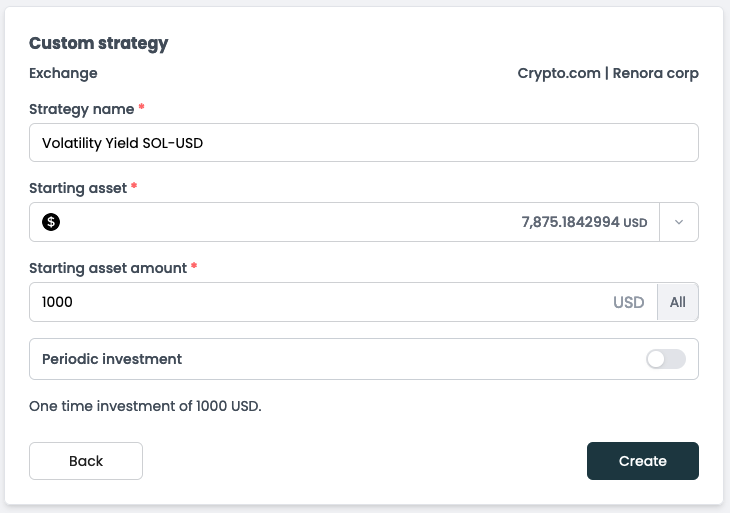

- Complete the investment amount setup of your custom strategy:

- Give your strategy a name

- Select starting asset (commonly used USD, USDT or USDC – depending on exchange’s trading pairs)

- Set starting asset amount

- Click “Create”

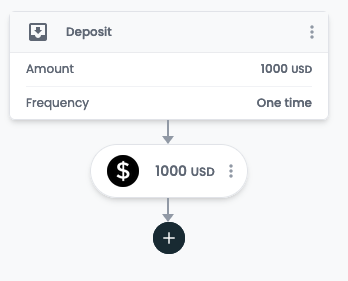

- This will create a strategy with an initial asset pool (1,000 USD in this example).

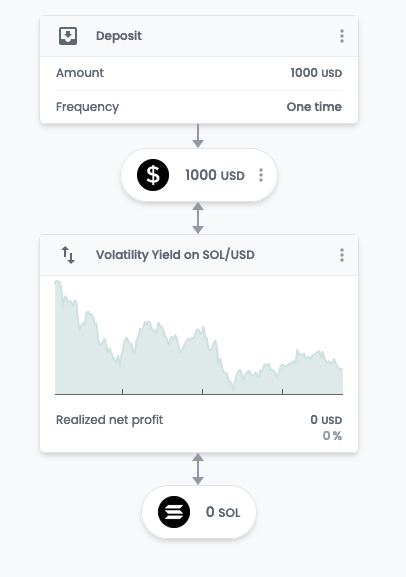

Click on + icon to create a new task and select Volatility Yield.

- Select the primary asset for the Volatility Yield from the drop-down list. In this case we will select SOL to create a SOL/USD Volatility yield trading pair.

- Once created remember to activate your existing strategy to let it run. Now you have a complete SOL/USD Volatility Yield strategy ready and running. The price chart will not have any executed trades at start and you will start seeing those once the strategy executes trades on the exchange.